What Is Dash?

Dash is an instant and semi-private cryptocurrency based off the Bitcoin and Litecoin code base. However, it includes various changes and improvements that have differentiated it since its debut in 2014. The project’s creator, Evan Duffield, built Dash to address three key issues he saw in the existing Bitcoin network: privacy, governance, and transaction speed. Over the past four years, Dash has risen to become one of the top global cryptocurrencies, with its market cap consistently placing in the top twenty cryptocurrencies despite a highly competitive market.

The main goal of Dash is to make digital cash more usable. Currently, you can send Bitcoin for online transactions and value transfers. However, the wait time for transaction confirmation on the Bitcoin blockchain makes it infeasible to use Bitcoin for in-store transactions or other value transfers that require near-instant confirmation.

Bitcoin’s high fees also make it a poor choice for smaller transactions, limiting its general usefulness as a digital currency for purchasing goods and services. As we’ll see, Dash seeks to solve these issues with its innovative architecture.

In this guide, we dive into:

- Dash History

- How Does Dash Work?

- Roadmap

- Trading

- Where to Buy DASH

- Where to Store DASH

- Conclusion

- Additional Resources

A Brief History of Dash

Dash began as a fork from the Bitcoin/Litecoin codebase. With its emphasis on privacy and transaction speed, it originally had a reputation as a coin for illicit transactions. In the early days, it was known as XCoin, but that name soon changed to Darkcoin, further playing into the idea that Dash’s privacy features could be used to hide sketchy transactions. Wanting to pivot away from the dark coin association, the community underwent a final name change to Dash, a portmanteau of “digital cash.”

The early days of Dash were characterized by the design and building of the currency’s unique two-tier architecture that facilitates fast transaction speeds and the coin mixing necessary for privacy. Shortly thereafter, Dash implemented a decentralized governance system that allows power users to vote on development proposals for the network.

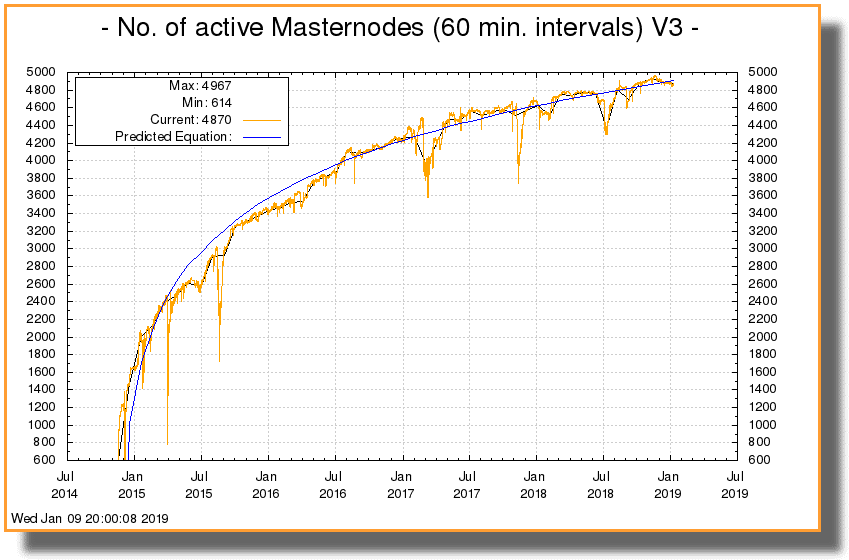

In the corporate world, four years is still a company’s infancy. However, in the rapidly growing and emerging cryptocurrency space, Dash is now one of the old guards. It represents one of the most stable and established cryptocurrencies currently on the market. This stability comes, in part, from Dash’s highly active community of users. These users have generated thousands of threads and comments about the project on Reddit and BitcoinTalk, and they’ve shared the project far and wide. Since creation, Dash has consistently added nodes to its network, increasing reliability and security with this growth.

How Does Dash Work?

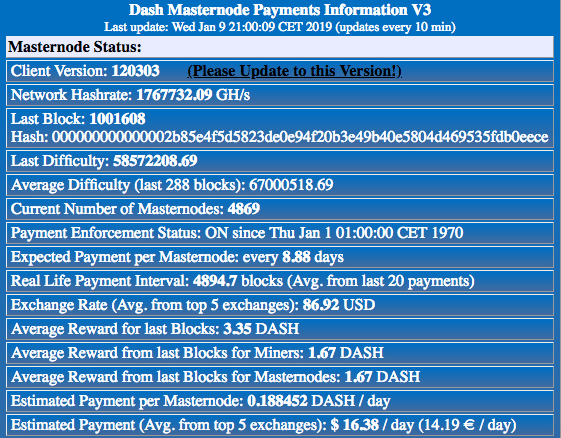

Dash’s innovation was a two-tiered structure to its blockchain. The first tier is familiar to anyone who has studied Bitcoin, Bitcoin Cash, Litecoin, and other standard proof of work cryptocurrencies. On Dash, miners are responsible for creating new blocks and securing the blockchain. In exchange for mining blocks, miners on Dash receive 45 percent of the block reward. This is in contrast to Bitcoin, where miners receive 100 percent of the block reward. The remaining 55 percent of the block reward is allocated elsewhere, as we’ll see shortly.

Dash has an average 2.5 minute block time, four times faster than Bitcoin. For the mining, the development team created a proprietary hashing algorithm known as X11 that requires sequential, repeated hashing. The X11 algorithm has been shown to use 30% less wattage than Litecoin’s Scrypt algorithm.

The second tier of Dash’s architecture is for servers set up by power users, known as masternodes. These masternodes process Instant Pay transactions, facilitate coin mixing, and vote on governance proposals. In exchange for these services, masternodes receive 45 percent of the block reward. Anyone can create a masternode on the Dash network, but you’ll first need to prove that you own 1,000 DASH (currently equivalent to around $90,000).

The 1,000 coin minimum is a security measure that prevents an attack against a peer-to-peer network known as a Sybil attack. Sybil attacks involve creating many fake accounts under pseudonyms, enough fake accounts to constitute a majority of the user base and therefore influence the network. By requiring 1,000 DASH to set up a masternode, it would be prohibitively expensive to carry out a Sybil attack against the masternode network. The 1,000 DASH minimum has the added benefit of keeping the price of the coin stable, and it ensures that when masternodes vote on governance proposals that they’re invested in the success of the entire network.

How Masternodes Facilitate Instant Payments

One of Dash’s key features is InstantSend. Since Dash wants to be a form of digital cash that people can use in stores, transaction verification needs to be instant. While a block time of 2.5 minutes means that Dash’s standard transactions are quicker than Bitcoin’s, 2.5 minutes is still too long to wait for your transaction to clear at the grocery store or gas station. The project’s solution is InstantSend payments verified by the network’s masternodes.

Essentially, you send your transaction to a masternode. The masternode locks the funds so they can’t be double spent and sends a confirmation once the funds are locked. The transaction itself still gets added to the ledger as part of a future block, but since the masternode has locked the funds, the transaction is guaranteed to get paid. InstantSend payments can receive verification in just a few seconds. Solving the problem of fast confirmations is a non-trivial hurdle for cryptocurrencies. Dash’s masternode solution is among a handful of options for instant processing of digital currency transactions.

Built-in Coin Mixing Promotes Anonymity & Privacy

Several third-party applications provide coin mixing services for Bitcoin, but as a default, Bitcoin transactions are publicly traceable. In addition, if someone ties your identity to your public address, they can monitor your incoming and outgoing transactions. This is problematic for the fungibility and usability of a digital cash system. In 2014, Dash became one of the first privacy coins available on the market (along with Monero in the same year). The network includes built-in coin mixing that makes it nearly impossible to trace transactions.

Dash calls its coin mixing service PrivateSend. At its most basic, when you want to send a private transaction, you send the request to the masternodes. One masternode broadcasts your mixing request and matches you up with other transactions happening at the same time, helping you move denominations of .1, 1, or 10 DASH between many users. Then, the first masternode passes your transaction to another masternode where the mixing process begins again, further obfuscating the trail.

Masternodes can’t directly learn the details of your transactions, but using such a coin mixing system does implicitly require that you trust the Dash network and the masternode operators. If privacy is your number one concern in a digital currency, Monero and Zcash have explored the issues of network trust and identity shielding in much greater detail. However, for most applications, Dash provides a high level of privacy and untraceability with its coin mixing.

Decentralized Governance Mitigates Hard Forking

We mentioned earlier that miners receive 45 percent of the block reward and masternodes receive another 45 percent. The remaining 10 percent is dedicated to the development, marketing, and infrastructure for the Dash network to continue to grow and improve.

One of the challenges Bitcoin faces is any time the user base disagrees on how to proceed with a change to the system, the result is a hard fork of the Bitcoin blockchain. Over time, this has fragmented the Bitcoin community into many smaller communities, including Litecoin, Bitcoin Cash, Bitcoin Gold, and even Dash. To solve this problem of fragmenting the community with hard forks, Dash implemented a decentralized governance model.

In Dash’s governance and voting system, anyone can propose a new feature, change, or marketing plan that will improve the Dash network. The masternodes then vote on each proposal. The number of yes votes for the proposal must outnumber the no votes by at least 10 percent of the total masternode number. For example, there are currently 4,800 masternodes on the Dash network. Therefore, for any new proposal, the yes votes would need to outnumber the no votes by 480 votes (10 percent of the total masternode count) in order for the proposal to pass.

Once a proposal passes, it receives funding from the block reward. In this way, Dash could, in theory, vote to fire its current development team if the community disagreed with the direction the team is taking.

Extending Usability With an App & API

The newest development in the Dash architecture is Dash Evolution. As part of the project’s goal of easy-to-use, instant digital cash, it needs a clear way to accept and make Dash payments. The project’s website describes the challenge as making digital transactions easy enough that your grandma could understand what to do.

To that end, Evolution is an API and mobile app that allows consumers to make payments and web stores to accept payments without having to interact with the blockchain client. While not yet fully implemented, the founders believe this is the next level of usability for digital cash.

[thrive_leads id=’5219′]

Roadmap

Unfortunately, the team hasn’t updated their roadmap since June 2018. As mentioned above, the next big milestone for the project is Dash Evolution. Beyond just an API and mobile app, Evolution includes:

- Shared file system (DashDrive)

- Light client wallets

- Updated budget voting and governance systems

- Social wallet with friends list and multisig accounts

It’s not clear when these new features will be available.

Trading

DASH had a fairly uneventful first couple of years price-wise. It wasn’t until the start of 2017 that the DASH price took off, blasting from around $10 (~0.0105 BTC) to reach an all-time bitcoin high of ~0.1083 BTC (or $110). That equates to a 1000 percent increase in USD and over 900 percent rise in BTC – within just three months.

This extreme price swing was most likely caused by a couple of factors. Arguably the most impactful cause was the announcement of a release date for the first steps of Evolution. It’s likely that this announcement, in combination with speculative investing, caused a short squeeze boosting the price higher than it organically would have.

Following the early 2017 price movement, the coin followed the general market for the most part. It’s worth noting, however, that the price tends to swing more volatilely than other altcoins – in both directions. DASH faired better than most altcoins during the 2018 bear market. Its price currently rests between $75 and $85.

Adoption is the name of the game for Dash at this point. Keep your eye out for Evolution release announcements as they’ve had a positive impact on the price in the past and they are directly linked to real-world adoption.

Where to Buy DASH

Surprisingly, lesser known exchanges have a high DASH trading volume than their more popular counterparts. For the highest volume, you should check out Bithumb and purchase the coin with KRW.

You can also get some DASH with USD on Bitfinex or with BTC on ETH on Binance.

Mining and Masternodes

Other than flat out buying DASH, you can also mine it or receive it as a masternode. Although you technically can mine the coin using a CPU/GPU, it’s no longer profitable, so you should do so with an ASIC miner instead. There’s no shortage of mining pools available for you to join.

Remember, to become a masternode, you need to stake 1000 DASH. Once you do, you can either run your own server for your masternode or set up a hosted masternode. The latter option is preferable if you’re part of the non-technical camp.

Where to Store DASH

Wallet, wallets, and more wallets. The number of DASH wallets is seemingly infinite. You’ve got the Core wallet for Windows, OSX, and Linux systems. The Exodus and Jaxx software wallets also support the coin.

Maybe you’re more of a hardware guy (or girl). Ledger, Trezor, and KeepKey all support DASH as well. Finally, you can kick it old school with the official paper wallet. Your options are endless

Conclusion

Dash has a strong track record and incredible community. Over the course of the past four years, the project’s decentralized governance has produced impressive improvements to the unique two-tier architecture of the network. As a result, Dash has seen steady, consistent growth that has kept it near the top of the pack of many altcoins. Keep an eye on this coin over the coming years, and expect consistent growth.

Editor’s Note: This article was updated by Steven Buchko on 1.9.2019 to reflect the recent changes of the project.

Additional Resources

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.